Thomas Gibbons brings law and governance expertise to the Waikato Community Lands Trust's mission of retaining land affordability for future generations.

His perspective centres on policy frameworks, funding structures, and the systemic changes needed to deliver housing across the entire continuum.

The Trust's establishment revealed immediate lessons about funding design. Hamilton City Council's initial grant was earmarked solely for land purchase, which on strict reading couldn't extend to even 'putting a spade in the ground.'

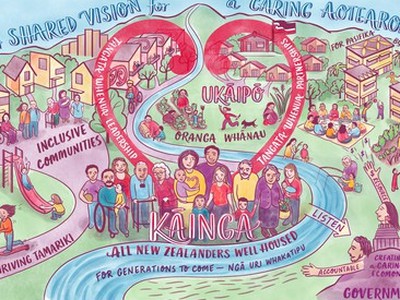

Working closely with council, they reshaped the funding arrangement to become fit for purpose, ultimately using it to purchase existing units rather than building new. "We compared that to the cost of establishing new housing and the cost difference was massive," Within the perpetual land ownership framework, the Trust aims to offer diverse products: affordable rentals, leasehold arrangements comparable to Secure Home products, and potentially shared equity models over time. The leasehold model particularly interests Thomas as it could deliver homes at half or less than half the cost of freehold properties. He notes "That's the intention. That's the goal. That there is that massive price difference and one is affordable to people in a way that the other, unfortunately now today, is not."

However, banking policies on leasehold remain a major impediment, but there are initiatives from banks like Westpac and others in NZ which have started to address this. There are also many unresolved issues around large rent reviews that treat residential leases like commercial ones. Thomas calls for central government attention to these barriers, whilst emphasising that leasehold should be one option within a suite of products, not the only choice for younger generations.

His analysis focuses relentlessly on the missing middle — the vast majority of housing delivered by the private market, which produces very few affordable homes. "We spend a lot of time talking about a very small part of the continuum around government community provision," Thomas argues, whilst the large market delivery aspect "really needs more attention from a policy point of view."

Policy levers matter more than funding levers when addressing housing at scale. What kinds of houses can be delivered? What housing is enabled by planning frameworks? What arrangements support up-zoning or Inclusionary Zoning? "Our planning system needs a lot of attention in terms of how and where housing is delivered," he emphasises.

The consequences of inaction extend far beyond housing stress. Home equity traditionally enables business establishment and economic activity. Unaffordable housing increases subsidy costs, drives families toward poverty, and curtails options for people in abusive relationships. "There are all kinds of adverse impacts from housing being unaffordable," he notes, lamenting that increasing house prices are still celebrated as positive outcomes.

He recalls party manifestos from the 1970s that held homeownership for young people as a critical social goal. "We've seemed to have abandoned that idea altogether," he reflects. "It is an indictment on us as a country that we can't think differently about how our housing system works."

Yet Thomas remains hopeful. "We can make different choices. We've done it before." The path forward requires comprehensive system thinking that addresses policy frameworks alongside funding to recognise that the 90% of housing delivered by the market, demands as much attention as the 10% provided through community and government channels.