I'll process this content for you with all the requested elements in UK English.

In a brand-new two-bedroom home in Cambridge, Waikato, Jennifer Palmer, General Manager of Bridge Housing Charitable Trust, explains how innovative financing structures are making home ownership accessible to families who would otherwise be locked out of the property market. The home, which would typically cost well over $600,000 in today's market, is available for $330,000 through Bridge Housing's Secure Home programme — a figure that represents a fundamental shift in how affordable housing can be delivered in New Zealand.

Bridge Housing's flagship Secure Home programme demonstrates how creative financing can slash housing costs by removing the most significant barrier to home ownership: land cost. Under this leasehold model, families purchase the house but not the underlying land, effectively halving the purchase price. She explains that this approach originated in Queenstown, where similar pressures around housing affordability led to the development of this innovative solution.

"In short, the household comes and they buy the house, but not the land. It really removes the land cost from that initial purchase price, meaning they're buying at about half the price."

The financial mechanics are straightforward yet revolutionary. Families secure a 100-year lease on the land while owning the dwelling outright.

They pay a nominal ground rent, a manageable ongoing cost that replaces the substantial upfront land purchase. This structure enables households with incomes starting from the mid $70,000s to access home ownership, a remarkable achievement in New Zealand's current housing climate.

Perhaps most importantly, the programme addresses the long-term financial sustainability concerns that might deter potential homeowners. When families decide to sell, they receive their original purchase price plus inflation, ensuring they build equity over time. The home then returns to Bridge Housing's affordable housing pool, maintaining affordability for the next family. Jennifer describes this as "a win-win" situation where "the household that's left, while they haven't had the big capital gains, they've done so much better than if they'd been renting, they'd been paying off their own mortgage and building equity."

Expanding access through shared equity

Recognising that even reduced purchase prices may be beyond some families' reach, Bridge Housing has introduced the First Home Partner programme, a shared equity model that further democratises home ownership. This co-ownership arrangement allows families to enter the market with as little as a 5% deposit, with Bridge Housing taking up to a 20% ownership stake in the property.

The shared equity model functions as a financial stepping stone, with families typically buying out Bridge Housing's share within ten years, transitioning to full freehold ownership. This approach acknowledges the reality that many families need time to build their financial capacity while still providing immediate access to the stability and equity-building benefits of home ownership.

For larger families requiring four-bedroom homes, the First Home Partner programme makes properties in the $600,000 range accessible — still challenging for many households but representing a significant improvement over market rates. Jennifer acknowledges that "that's completely unaffordable for a lot of people," highlighting the ongoing need for multiple intervention points across different income levels and household sizes.

Banking partnerships: making innovation mainstream

The success of Bridge Housing's programmes relies heavily on forward-thinking banking partnerships, with Westpac Bank playing a particularly crucial role. Jennifer describes Westpac as "amazing to work with" and notes their support has been comprehensive, covering both development finance and household lending. The bank's willingness to provide mortgages for leasehold properties represents a significant innovation in New Zealand's lending landscape.

"Westpac has been amazing to work with. They've been supportive. They've provided the development finance for a number of our developments and also lending to our households."

"It's innovative to offer a mortgage sort of product effectively to a family who are buying the house but not the land," Jennifer acknowledges. This required banks to reassess traditional lending criteria and recognise the security inherent in the leasehold model. The partnership demonstrates the "very, very low risk to the bank" while opening new pathways for families to access finance.

More recently, ASB has joined as a partner for the First Home Partner programme, indicating growing banking sector confidence in these alternative ownership models. Jennifer expresses hope that this trend will continue, with more financial institutions recognising the viability and social impact of these innovative lending approaches.

The involvement of Hamilton City Council in providing development finance for their Hamilton projects further demonstrates how diverse funding sources can be assembled to make affordable housing financially viable. This multi-partner approach to financing has proven essential for scaling affordable housing delivery.

The economics of affordability

Bridge Housing's approach to affordability is pragmatic rather than formulaic. Rather than working to predetermined affordability ratios, Jennifer explains their philosophy: "It's as affordable as humanly possible." This means stripping away non-essential features and costs at every stage of development, from design to construction to financing.

"We don't really have a definition. It's as affordable as humanly possible. So every time we work with planners or architects or lawyers or whoever it might be, that is the number one pillar."

The trust's commitment to maximising affordability extends to their partnerships with architects, planners, and other professionals, with cost reduction being the primary consideration for every decision. Jennifer notes that "there won't be Juliet balconies and there won't be this and there won't be that," emphasising function over form to keep costs minimal.

This approach has yielded remarkable results, with recent developments in partnership with local builders achieving sale prices as low as $292,000 for two-bedroom homes. These prices enable household incomes in the mid-$70,000s to access home ownership — a demographic typically excluded from traditional lending scenarios.

However, she acknowledges the limitations of any single approach, noting that "we still had applicants who couldn't afford that, of course." This reality underscores the need for multiple intervention points and programmes targeting different income levels and household compositions.

Overcoming financial literacy and trust barriers

Despite offering homes at roughly half market price, Bridge Housing discovered that price alone wasn't sufficient to generate immediate uptake. The organisation now has 26 households living under their programmes, but Jennifer notes "It took us two years to get there." This timeline reflects the significant education and trust-building required to help families transition from rental to ownership mindsets.

The Trust employs a dedicated staff member, who works intensively with families, often for eight months to a year, addressing financial literacy gaps and building confidence in the home ownership process. This support includes practical assistance like ensuring families contact lenders and complete necessary paperwork, as well as holding them accountable for meeting financial obligations.

Jennifer explains that many families are "intergenerational renters" for whom "the possibility or the option of home ownership is not even in their universe of available choices." Overcoming this psychological barrier requires sustained relationship-building and education about the differences between renting and owning, as well as the specific mechanisms of Bridge Housing's programmes.

Development finance and sustainability

Bridge Housing's financial model relies on a balanced approach combining charitable funding, government support, and market-rate development. The organisation develops some properties for sale at market rates, using these profits to subsidise their affordable housing programmes. This approach creates a sustainable funding cycle while reducing dependence on external grants and donations.

The Brian Perry Charitable Trust has been instrumental in this model, donating approximately $10 million worth of land to make developments financially viable. She explains that such generosity "must obviously come to an end at some point, and we'll need to find other sources of land discounted," highlighting the ongoing challenge of land acquisition costs.

Government programmes have also been crucial, with Jennifer noting the importance of schemes like the Progressive Home Ownership (PHO) programme, which provided interest-free loans for affordable housing developments. The withdrawal of such programmes has created what she describes as a "middle of the continuum gap" that makes financing affordable housing significantly more challenging.

The role of inclusionary housing and zoning

Looking toward systemic solutions, Bridge Housing strongly supports inclusionary zoning as a mechanism for securing affordable housing within mainstream developments. Jennifer explains this as sharing "the value uplift" that occurs when developers receive consents, arguing that "affordable housing is integral to our community" and developers should contribute their share.

Trustee Peter Southwick frames this differently, suggesting that affordable housing provision should be a prerequisite for development consent rather than an afterthought. This approach would fundamentally alter the financing dynamics of development, making affordable housing a standard component of new housing supply rather than an exceptional add-on.

The organisation supports both local and central government implementation of inclusionary zoning, recognising that a national framework could reduce litigation risks for individual councils while creating consistent expectations across regions.

Future financing challenges and opportunities

Jennifer identifies access to affordable land as the primary constraint on scaling their model, noting the need for "inclusionary zoning, whatever that might look like, but working with developers to ensure that a portion of every development is affordable and genuinely affordable." This systemic approach to land supply could dramatically improve the financial viability of affordable housing development.

The recent announcement of government support for the Community Housing Funding Agency represents a significant opportunity, with Jennifer welcoming the prospect of reduced borrowing costs. "If we can drop the cost of finance, amazing," she notes, describing it as another crucial lever in bringing down overall housing costs.

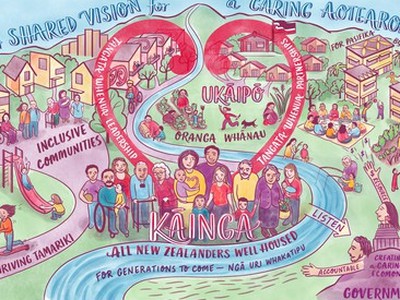

However, Jennifer is realistic about the complexity of housing system change, stating definitively that "there is absolutely not a silver bullet." She emphasises that sustainable solutions require "interventions from all of the parties," including local government, central government, community housing providers, developers, and financial institutions.

"There is absolutely not a silver bullet... You know, it takes interventions from all of the parties... we all have to be doing different things and developers certainly have a role to play."

Regional impact and scalability

The Hamilton region faces particular challenges, with Jennifer noting it has "one of the lowest rates of home ownership in the country, in fact, potentially the lowest rate." With home ownership rates approaching 50%, the region faces a looming retirement crisis as renters age without building equity or securing stable housing.

"We're going to be at a point where less than 50% of people own their own homes, which may not seem like a crisis today, but the crisis is coming... if we don't have that in place here, we are facing a future train wreck."

The rental market's extreme tightness — with Lodge Real Estate managing 4,000 people seeking rentals while having fewer than 20 available properties at any time — demonstrates the urgent need for alternative housing pathways. Bridge Housing's model offers a replicable approach for other regions facing similar challenges. The combination of leasehold and shared equity programmes, supported by innovative banking partnerships and strategic use of charitable resources, provides a framework that could be adapted to different local contexts and market conditions.

A blueprint for affordable home ownership

Bridge Housing's experience in Cambridge and the wider Waikato region demonstrates that innovative financing can make significant inroads into housing affordability challenges. By removing land costs through leasehold arrangements, providing shared equity pathways, and building strong banking partnerships, the organisation has created home ownership opportunities for families earning between $75,000 and $130,000 annually.

The success of these programmes relies on multiple subsidy layers and partnerships across sectors, confirming Jennifer's assertion that "everyone has to do their part." As the Community Housing Funding Agency begins operations and government support structures evolve, models like Bridge Housing's leasehold and shared equity programmes point toward scalable solutions for New Zealand's housing affordability crisis.

The key insight from Bridge Housing's work is that affordability isn't just about building cheaper houses — it's about reimagining the entire financing ecosystem around home ownership. Through creative partnerships with banks, councils, and charitable trusts, combined with innovative ownership structures, they've demonstrated that significant progress is possible even within current policy constraints. As Jennifer concludes, while there may be no silver bullet, sustained effort across multiple fronts can create meaningful pathways to home ownership for families currently excluded from the market.