Heiko Jonkers is Senior Product Manager — Social and Affordable Housing at Westpac New Zealand, a role that places him at the intersection of finance and social impact. With over two decades of experience in credit strategy and property lending.

At the recent CHA Conference, Heiko Jonkers from Westpac offered a compelling perspective on how the banking sector can play a pivotal role in addressing New Zealand's housing affordability crisis. With over 20 years of experience in credit strategy and property lending, Heiko has transformed his role from a traditional banking position to becoming a passionate advocate for affordable housing solutions.

A personal journey into affordable housing

Heiko's involvement in affordable housing began five years ago through an unexpected opportunity to create funding packages for prefabricated homes. This initial exposure to the challenges of securing finance for non-traditional housing led to deeper conversations about shared equity and leasehold opportunities, ultimately revealing the scale of need within New Zealand's community housing sector.

He reflected, "I've never had a role where I've felt more passionate about what I do", describing how what began as a side-of-desk activity evolved into a full-time commitment at Westpac. His transition highlights a growing recognition within the banking sector that addressing housing inequality is not just a social imperative, but a business opportunity that aligns with corporate values.

The stark reality of housing inequality

"The average age of first home buyers is now 37. So if people aren't getting into their home until they're 37, they're already over 25% through their working life."

The statistics that he shared paint a troubling picture of New Zealand's housing landscape. This delay has cascading effects that extend far beyond individual home ownership aspirations.

"People who live in their own homes have better health outcomes. The houses are better quality. They're better looked after."

He emphasised that home ownership enables people to leverage their property as security for business ventures, particularly important in New Zealand where 97% of businesses are small enterprises that rely on family homes as collateral.

The delayed entry into home ownership creates a concerning cycle: people buy more expensive homes later in life, requiring larger portions of their income to service mortgages, leaving less time and capacity to save for retirement.

This trajectory suggests a future where more people will reach the end of their working lives without adequate housing security, ultimately requiring government support.

Innovative financial solutions: shared equity and leaseholds

Heiko outlined two key financial innovations that Westpac is championing to address housing affordability: shared equity and leasehold structures. These approaches recognise that the fundamental problem is not necessarily the borrower's creditworthiness, but the mismatch between house prices and what people can afford.

Using a $100 house analogy, Heiko explained how shared equity works: if a buyer has $10 in equity and can borrow $65, they're $25 short of the purchase price. A community housing provider, charity, iwi, or church can contribute that $25, becoming a 25% stakeholder in the property. The homeowner then has 15 years to buy back that equity at market value, sharing in any capital gains proportionally.

He noted that the equity partner's share may increase in value, so does the home owner's portion, creating leveraged upside for the buyer.

"A rising tide raises all boats. So if the value of the equity is going up, the value of the borrowers' equity that they've put in the home is also going up."

Leasehold structures offer another pathway, where buyers purchase long-term rights to occupy land rather than owning it outright. While acknowledging that leasehold is not as advantageous as freehold ownership, Heiko argued that it's still superior to renting without any investment return, particularly when properly structured with long terms (50-100 years) and capped ground rent increases.

Banking sector transformation

Westpac's approach to these innovative housing solutions reflects a broader shift in banking attitudes. Heiko emphasised that borrowers in shared equity or leasehold arrangements are not necessarily vulnerable — they simply need smaller loans. This perspective allows the bank to treat these customers as standard borrowers, providing the same rights, benefits, and pricing as traditional mortgage products.

He explains that "The product that the customer gets from Westpac is a standard mortgage, but it's a mortgage that's been right-sized to the level of affordability." This approach removes the stigma and additional complexity that might otherwise discourage potential homeowners from exploring these options.

The bank's commitment extends beyond just providing finance. Heiko described how Westpac offers free advisory services to Community Housing Providers (CHPs), helping them structure operations and understand banking requirements. This collaborative approach aims to build long-term relationships and sustainable housing solutions.

The scale of the challenge

Despite these innovations, Heiko was candid about the scale of the challenge facing New Zealand. The entire community housing sector has delivered only a very small percentage of the homes needed, while the actual need runs into hundreds of thousands. This reality demands what he termed a "bulk approach" to make meaningful progress.

The solution, according to Heiko, requires either house prices to decrease gradually or incomes to rise faster than house price inflation. Given the risks associated with rapid house price declines, the focus should be on modest house price growth combined with income increases, alongside greater acceptance of alternative ownership models.

Government partnership and policy consistency

Heiko identified policy consistency as the single most important factor the government could address. He pointed out that construction markets cannot respond quickly to policy changes, yet housing strategies shift every two to three years with changes in government.

This instability makes it difficult for CHPs to plan, reduces bank confidence, and prevents the construction sector from scaling up effectively. He argues that long-term policy certainty would allow all stakeholders to plan effectively and deliver housing solutions at scale. "Rather than just focusing on the banking aspects of that, the key lever that the government could pull, and it's really just one lever, consistency".

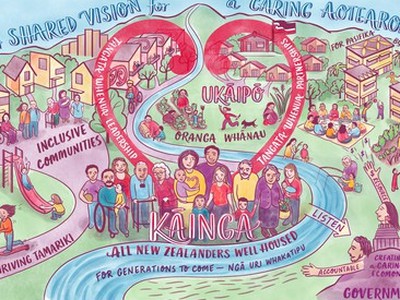

While acknowledging the Government's current focus on moving people from emergency housing into Income Related Rent Subsidies (IRRS), Heiko advocates for a broader approach that includes pathways to home ownership. He noted that renting, while providing shelter, doesn't offer the same longer-term benefits of home ownership such as security of tenure, connection to community and the ability to build intergenerational wealth.

A call for collaboration

"Banks aren't these big, horrid institutions that just want a straight financial return and are driven by corporate greed. Banks have huge motivation to affect positive societal change."

Heiko concluded with a clear message: banks want to help and are motivated to create positive societal change. He emphasised that Westpac is available to work with any organisation, whether planning one house or 100, and that this assistance comes without charge.

His vision for the future involves stronger partnerships between the private sector and government, where public funding is used more efficiently through collaboration rather than operating in isolation.

The goal is not to replace government involvement but to create models that maximise the impact of public investment while leveraging private sector expertise and resources.

The interview revealed that behind the corporate facade of major banks lies a genuine commitment to addressing New Zealand's housing crisis. However, success will require sustained effort, policy consistency, and a willingness to embrace innovative financing models that challenge traditional approaches to home ownership.

As Heiko demonstrated, the banking sector stands ready to be part of the solution — the question is whether all stakeholders can work together to create the stable, long-term framework needed to deliver housing at scale.